User Query: Using QuickBooks Enterprise 2022, I want to ask that yesterday i didn’t received money from one of my client and now how to write off bad debt in QuickBooks Desktop, tell me what to do?

If you’re using QuickBooks Desktop, here’s how to write off bad debts.

What is Bad Debt & How to write off bad debt in QuickBooks?

Bad debts are the collectible from the customers gone bad i.e. the customer will not be able to pay the debts back. Since businesses use the accrual method of accounting, therefore, you may have to write off bad debts from time to time. When the customer is unable to pay the debts even after sending the invoice, then the bad debts will have to be recorded and will have to be written off.

QuickBooks File Recovery – How to Fix Data Corruption?

Notes: If you are using QuickBooks Desktop, here are the checklist how to write off bad debt.

- The first step is to check your aging accounts receivable.

- The second step is to create a bad debt expense account.

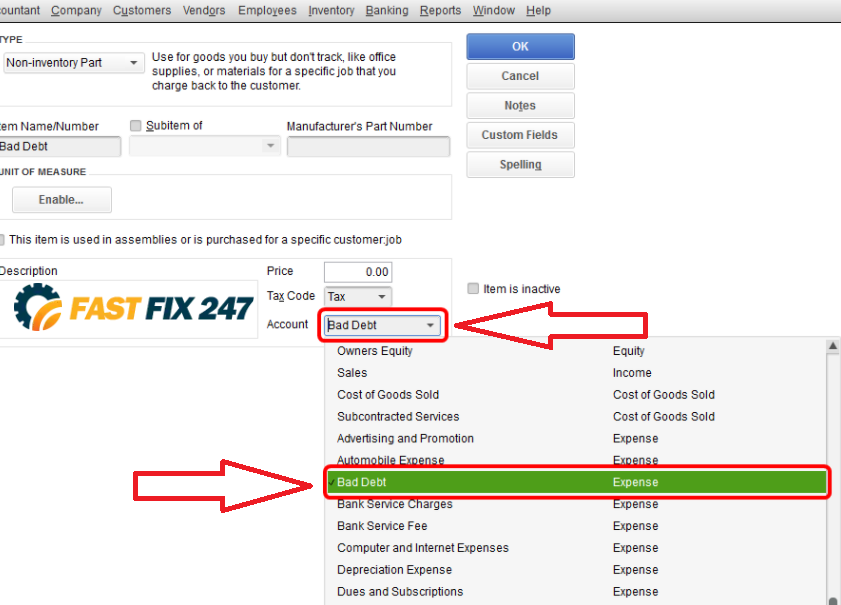

- The third step is to create a bad debt item.

- The fourth step is to create a credit memo.

- The fifth step is to apply the credit memo to the invoice.

- The sixth step is to run a bad debts report.

Steps to writing off the bad debts in QuickBooks

Step 1. First of all, you need to check for the aged receivables. This check should be done regularly like every month. For this purpose, you need to go on the reports menu and open account receivables ageing details, and check for the amounts that need to be written off.

Step 2. In the next step, you will have to create the bad debts expense account. For this purpose, you need to go on settings > chart of accounts > New > Account types > expenses > details type > bad debts. Now, in the name field, you need to enter the bad debts again and save and close.

Step 3. Now in this step, you need to create a bad debt item by going on to settings > product and services > New > non-inventory. In the name field enter bad debts, from the income accounts select bad debts, and save and close.

Step 4. In the next step, create the credit note for the bad debts by clicking on New > credit note/ give credit > select the customer > select bad debts in product and services > enter the amount you want to write off. In the message box write “bad debts”, then save and close.

Step 5. Now in this step, you need to apply the credit note by clicking on New > receive payment/ receive invoice payment > select the customer from the drop down > select the invoice from the outstanding transaction section. Now, select the credit note, then save and close.

Step 6. Finally, run the bad debts report by going on to settings > chart of accounts > run reports in the action column.

You can also add a note to the bad debt entity to show them apart by going to the sales menu > select customers > select customer name > edit. In the display name field against the customer name, enter the “bad debt” or “no credit” and select save.

Note: A bad-debt entity can be distinguished from your other customers by adding a note to their name:

- Select Customers from the Sales menu.

- Click the name of the customer.

- Then click the Edit button.

- After the customer’s name, enter “Bad Debt” or “No Credit”.

- Click the Save button.

We hope that the above steps will guide you in writing off bad debts in the QuickBooks. However, in case you still need further information on any point or have some queries in your mind, you can contact LIVE CHAT, our helpdesk will help you.

Frequently Asked Questions

Here are few most asking questions related to write off bad debt in QuickBooks.

How to make a credit memo for the bad debt in QuickBooks?

Here are the steps to follow:

1. Choose + New.

2. Now Select Credit memo.

3. Pick the customer from the Customer ▼ Drop-down.

4. In the Product/Service section, choose Bad debts.

5. In the Amount column, add the amount you want to write off.

6. In the TEXT displayed on statement box, enter “Bad Debt.”

7. Select Save & Close.

Few More Reads:

How to Handle Customer Credits in QuickBooks?

What to do if Credit Card transaction is not correct in QuickBooks?

How to Void a Check in QuickBooks?

How to Resubscribed to Intuit QuickBooks Payroll?

How to Reactivate QuickBooks Account for Payroll Subscriptions?